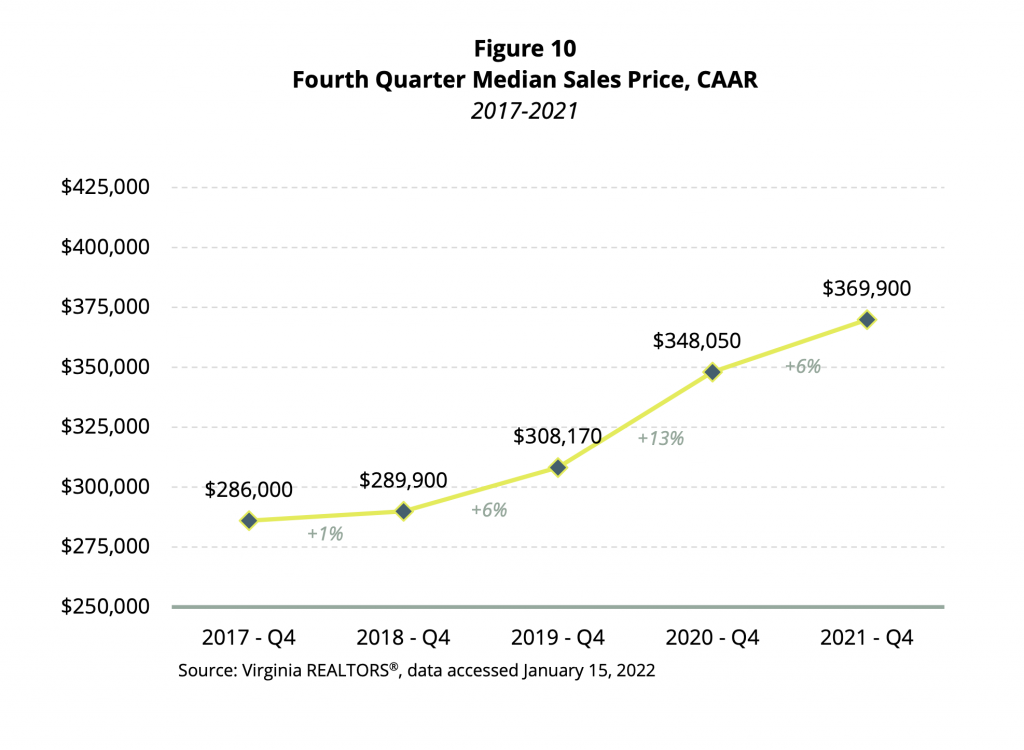

Charlottesville is getting more expensive, and fast. In the fourth quarter of 2017, the median sales price for a home in the Charlottesville area was $286,000. In the fourth quarter of 2021, the median sales price for the region was $369,000—a 29 percent increase in just four years.

Those rising prices affect everyone in the city, whether or not you’re buying or selling a home. Increased sale prices drive up the value of neighboring homes, which in turn increases the amount homeowners owe in real estate taxes. In January, the city announced that average residential property assessments rose 11.69 percent from last year to this year.

Meanwhile, seeking to generate revenue for major projects like a renovation of Buford Middle School, the City of Charlottesville is considering raising the real estate tax by as much as 10.5 percent. Currently, Charlottesville taxes real estate at 95 cents per $100 of assessed value. The city has said it could raise the rate to $1.05.

A little back-of-the-napkin math shows how the increased assessments and potential tax increase might affect an average homeowner. If you own a property that was assessed at 350,000 in 2021, you owed $3,325 in real estate taxes. If that property’s assessment increased by 12 percent, and real estate taxes increased by 10 cents, your 2022 real estate taxes would be $4,116, or $791 more than you paid the year before.

End of fourth quarter median sale price, Charlottesville area (2017-21)

“There are lots of wealthier people in Charlottesville who can afford it,” says City Councilor Michael Payne, “but there’s also definitely a lot of people who it’s going to be a real hit for.”

Real estate assessments are entirely based on the real estate market, says City Assessor Jeff Davis. “We witnessed, this year, a very strong real estate market,” Davis says, and the increased assessments reflect the increased sale prices of homes in the city over the last year. From 2020 to 2021, residential property assessments rose 3.8 percent, compared to the 11.69 percent increase from 2021 to 2022.

“We have the city broken up into neighborhoods, and we look at these neighborhoods and determine from the sales where assessments need to change,” Davis says. Neighborhoods where assessments rose at particularly sharp rates include Orangedale—comprised of Orangedale Avenue and neighboring streets, on the city’s map—which saw assessments jump 24 percent. Rose Hill, the neighborhood between Burley Middle School and Preston Avenue, and University/Maury, which encompasses Jefferson Park Avenue and its smaller offshoots, each saw 18 percent increases.

“It’s like any other product,” says Pam Dent, president of the Charlottesville Area Association of Realtors. “Supply and demand is going to result in rising prices…The market has been really strong, and we’ve had extremely low inventory.”

It’s not just a Charlottesville phenomenon. Assessments jumped in Albemarle County, too. The county, which taxes real estate at 85.4 cents per $100 of assessed value, saw residential real estate assessments rise by 8.4 percent this year. Around the country, the median home sale price has risen 21 percent since the end of 2017.

The tight market “hasn’t happened overnight,” says Dent. The 2008 recession slowed new construction, just as Charlottesville was becoming an even more popular place to live, she says. Rising interest rates encouraged people to stay put, and the onset of the pandemic “put it all on steroids,” as supply chain issues disrupted construction further.

“You’ve got the same dynamics that have been creating the affordable housing crisis just accelerating,” says Payne.

CAAR’s fourth quarter report for 2021 provides more detailed data on the lack of new homes for sale. “In the CAAR footprint, there were 436 active listings in the region at the end of the fourth quarter, which is 213 fewer active listings than a year ago, a decline of 33%,” the report states. “The Charlottesville region remains one of the tightest housing markets in the state. Inventory is now just a third of what it was four years ago.”

The average time a house spends on the market has fallen significantly over the last few years as well. In the fourth quarter of 2017, houses stayed on the market an average of 79 days. In the fourth quarter of 2021, the average time was just 31 days.

A few days after the year’s new assessment data was published, City Council took the first steps toward raising the real estate tax. The councilors have not yet decided how much to raise the rate, if at all, but in order to meet their ambitious capital improvement goals, council will need new sources of income. A public hearing is scheduled for March 21 to discuss the potential tax rate increase further.

Payne says improving the city’s real estate tax relief program is one crucial way to ease the pressure caused by increased assessments and potential new taxes.

“We don’t have any plan to make our real estate tax relief programs robust enough to prevent harm to those who can’t afford this,” he says.

Currently, those with homes assessed at $375,000 or below can qualify for real estate tax relief. Expanding that program requires an amendment to pass through the Virginia General Assembly.

Dent says CAAR does not take a position on real estate tax increases either way, but posits that a tax rate increase will have knock-on effects. “Renters will see increases in their leases based on tax increases, and consumers will see increased costs for services and labor from increased overhead.”

Payne also says it’s important that the city consider creating other forms of revenue beyond raising taxes, and thinks looking to the general assembly and UVA could be crucial. With so much turnover in the city’s management, long-range planning has been difficult.

Creating revenue “without putting the squeeze on working class people in the city” is “not an easy task, and it’s not going to happen in one budget cycle,” says Payne, “but one of the realities we have to confront is we haven’t done nearly enough long-range strategic planning.”

For the moment, “it’s the strongest seller’s market that I’ve ever seen,” Dent says.

Updated 2/23 to correct an error in reporting the real estate tax rate in Albemarle County.