Albemarle County is reporting another increase in average property values for 2024, but its not as high as in the past two years.

“This year what we’re looking at is a 4.07 percent overall increase to the tax base based on the reassessment,” says Peter Lynch, Albemarle’s assessor.

Albemarle switched to annual assessments in 2009, which means 15 years of data to sift through. Average values declined the first five years, with a decrease of 2.3 percent in 2013. Percentage changes have been positive ever since, with highs of 8.4 percent in 2022, and 13.46 percent in 2023. This year’s values are on a par with 2019, when 4 percent was at the time a record-setting increase.

“Luckily this year, at least to me, it makes our job a little easier when those increases aren’t so high as they were the last couple of years,” Lynch says.

Lynch explained to the Board of Supervisors how his staff audits the sales that are based on valid fair-market transactions. Invalid ones do not contribute to the calculations, such as the county’s $58 million purchase of 462 acres around Rivanna Station.

An example of a valid transaction is the December 19, 2023, purchase of a four-bedroom house on Shiffletts Mill Road in the White Hall District for $1.3 million. That was 26.58 percent above the 2023 assessment.

That transaction was one of 1,856 valid market sales in 2023, down from a high of 2,389 in 2021. In all, there are 37,419 taxable properties in Albemarle as of the end of the year.

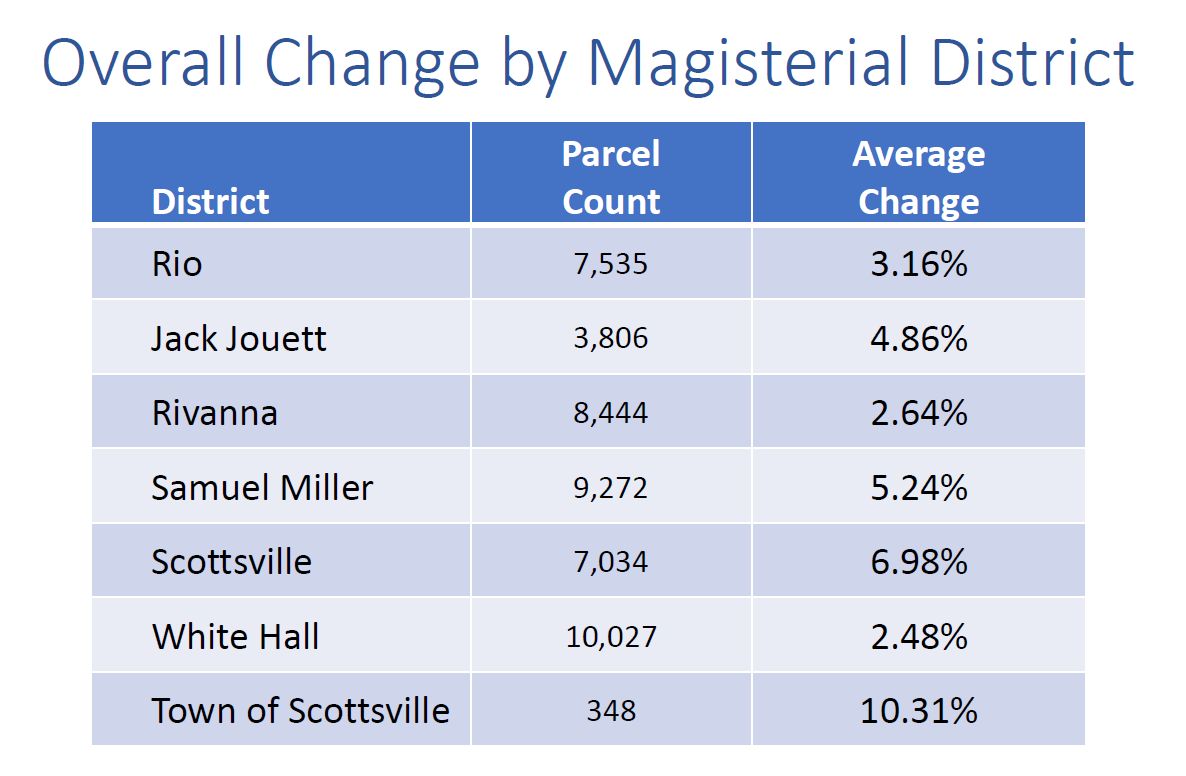

Assessments were up highest in the 348 parcels of land in the Town of Scottsville, which had a 10.31 percent average increase. The Scottsville Magisterial District is next with the 7,034 parcels having an average increase of 6.98 percent. The average increases were smaller in Rivanna and White Hall, with figures of 2.64 percent and 2.48 percent, respectively.

Lynch can also break the data down via land classification. The 23,093 parcels designated in the Comprehensive Plan as Urban Residential increased an average of 4.49 percent and the 17,540 classified as “Other Residential up to 20 acres” increased by 4.28 percent. The 1,387 properties listed as Commercial/Industrial went up 3.09 percent.

Actual numbers will vary depending on unique circumstances.

“The majority of the properties are going to experience a negative 5 to a positive 5 percent change,” Lynch says. “An additional 32 percent will increase a 5 percent to 15 percent increase.”

Six percent are in excess of 15 percent.

But why the increase? Lynch says one possible explanation is that construction of new homes has not kept up with demand. Data from the county’s Community Development reports the issuance of a total of 408 certificates of occupancy in 2015, a number that climbed to 1,143 in 2020 before dropping back to 779 in 2022.

Anyone who wishes to dispute their assessment must contact the assessor’s office by February 28. Applications to appeal to the Board of Equalization are due April 1.

The City of Charlottesville will release their property assessment data on Friday, January 26, with notices being mailed out on January 30.