To tax or not to tax

The Virginia Supreme Court is considering the merits of an appeal brought by the City of Charlottesville in a lawsuit over who is required to pay its business license tax.

Best-selling author Corban Addison sued the city in 2019 after receiving a letter telling him he was required to pay the tax based on his income as a freelance writer for current and previous years.

“I have lots of author friends, and none of them at that point that I knew was paying a business license tax in the county or the city,” Addison says. “It was just sort of logical because I wasn’t inviting customers. I didn’t have… a physical plant that was just creating intellectual property and licensing it to publishers.”

Addison, who is also an attorney, read the city code and didn’t see how it applied to freelancers.

“My response to the city was, how am I a service? I mean, that really is the nub. The fundamental issue in the case, even now in front of the Virginia Supreme Court,” says Addison.

The Charlottesville Circuit Court agreed with Addison and ruled against the city. The Virginia Supreme Court heard arguments in the city’s appeal on April 20.

Attorney Keith Neely with the Institute for Justice, the organization representing Addison, says the Virginia Supreme Court’s ruling could have significance well beyond the City of Charlottesville.

“There are many municipalities across the state of Virginia that share similar tax codes,” says Neely. “So this could have some far-reaching ramifications on taxpayers across the commonwealth.”

A similar lawsuit brought by author John Hart in Albemarle County has been stayed while the Charlottesville appeal continues.

Same pattern

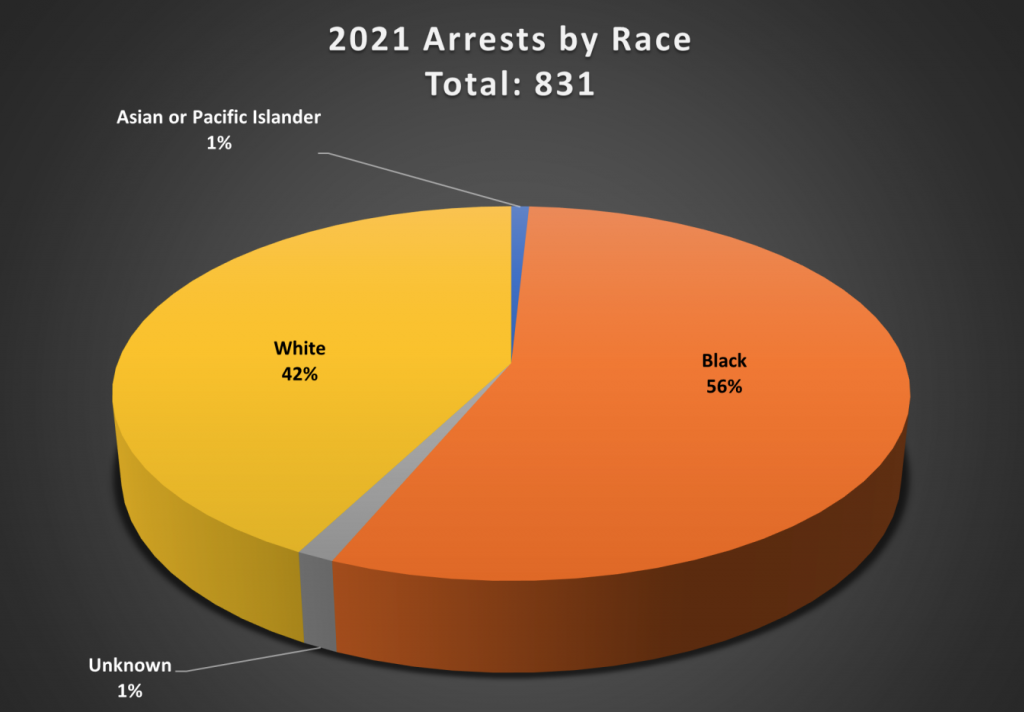

Last week, the Charlottesville Police Department released its 2021 annual report, revealing the continued disproportionate arrests of Black residents.

Both in 2020 and 2021, 56 percent of people arrested in Charlottesville were Black, while 42 percent were white. Only about 15 percent of the city’s population is Black, according to the 2020 census.

However, 2021 had 831 arrests—a slight decrease from 2020’s 922 arrests.

Last year, there were no homicides, but around a 20 percent increase in “crimes against persons,” including 19 forcible rapes, 121 aggravated assaults, and 496 simple assaults. In 2020, there were four homicides, 17 forcible rapes, 115 aggravated assaults, and 368 simple assaults.

Though there was a slightly more than 5 percent drop in “crimes against society” in 2021, there was about a 17 percent rise in “crimes against property,” largely burglaries, destruction of property, thefts of motor vehicles, and other larcenies. The largest uptick was thefts of motor vehicle parts or accessories, which rose from 47 incidents in 2020 to 172 in 2021.

Despite calls from community members to reallocate police funding to community services, this month City Council approved a $20 million CPD budget for the next fiscal year—a nearly 7 percent increase from last year.

Photo: City of Charlottesville

In brief

High roller

It could be your lucky day—a Powerball ticket worth $50,000 purchased at the Fas Mart on Rolkin Road on November 1 hasn’t been claimed. The ticket matched four of the first five winning numbers—9, 25, 34, and 44—and the 8 Powerball. The winner must contact the Virginia Lottery before 5pm on May 2 to take home the prize.

Order up

After doing takeout only at its new IX Art Park spot for the past two years, Lampo will reopen its original Belmont location for dine-in this summer. But if you still want to grab a slice to go, Lampo2GO will remain open at IX.

No relief

The Virginia Rent Relief Program will stop accepting new applications on May 15. State officials claim the program has recently received a surge in applications, and may not have enough funding available to fulfill the requests. Those from households that make less than half their area’s median income—or with one or more people who have been unemployed for at least 90 days—will be prioritized until the deadline.

Slow down

The family of Rahmean Rose-Thurston unveiled a new memorial on Fifth Street last week, in honor of the 23-year-old Charlottesville resident who died in a motorcycle accident on the road in 2020. In the last six years, seven people have died in accidents on Fifth Street. Last month, the city lowered the speed limit from 45 to 40 mph, and announced plans to hire an engineering firm to consider additional safety improvements.

Anti-anti-racism

Former Agnor-Hurt Elementary assistant principal Emily Mais filed a lawsuit against Albemarle County Public Schools claiming school employees harassed and retaliated against her after she used the term “colored people”—instead of “people of color”—during a training session, and complained about the division’s anti-racism policy. The complaint alleges Mais, who is white, was forced to resign due to a “racially hostile and divisive work environment” in August.